December 2, 2015, seemed no different than any other day in Washington, D.C. With a light rain falling, it was a rather dismal day for sightseeing in our Nation’s Capitol – yet the sun seemed to be shining for our small and emerging businesses in the Halls of Congress.

You see, after months of bi-partisan jockeying and wrangling in Congress, and the aroma of 2016 elections not too far off in the distant future, it was finally time for both political parties to get down to business – small business, that is – the job creators and the engine of our economy. It was time for the Capital Markets Subcommittee of the House Financial Services Committee to hold hearings on five bills, grouped under the heading: “Legislative Proposals to Improve the U.S. Capital Markets.”

Two of the bills in particular caught my eye, simply because I had written extensively as to the need for action in these areas, either by the SEC or byCongress. The first bill, entitled “SEC Small Business Advocate Act, HR 3784, would create a new independent office of small business advocate at the SEC, intended to protect the interests of small and emerging businesses and their investors, reporting both to the Commission and to Congress. Originally introduced in October 2015 with the bi-partisan sponsorship of four Representatives, by the time these December 2 hearings had commenced it had picked up at least one additional co-sponsor, Representative Carolyn Maloney, the ranking Democrat on this Committee. In her words, HR 3784 was nothing more than “common sense.” It had the support at these hearings in the form of testimony from the U.S. Chamber of Commerce, the Biotech Industry Organization (BIO), and the Small Business Investor Alliance. To me, this was the plain vanilla ice cream that went so well with Mom and Apple Pie.

Two of the bills in particular caught my eye, simply because I had written extensively as to the need for action in these areas, either by the SEC or byCongress. The first bill, entitled “SEC Small Business Advocate Act, HR 3784, would create a new independent office of small business advocate at the SEC, intended to protect the interests of small and emerging businesses and their investors, reporting both to the Commission and to Congress. Originally introduced in October 2015 with the bi-partisan sponsorship of four Representatives, by the time these December 2 hearings had commenced it had picked up at least one additional co-sponsor, Representative Carolyn Maloney, the ranking Democrat on this Committee. In her words, HR 3784 was nothing more than “common sense.” It had the support at these hearings in the form of testimony from the U.S. Chamber of Commerce, the Biotech Industry Organization (BIO), and the Small Business Investor Alliance. To me, this was the plain vanilla ice cream that went so well with Mom and Apple Pie.

So Who Might Oppose HR 3784 You Ask?

Well, as one who is a lawyer by training, there are at least three sides to be argued to every coin. The proposed SEC Office of Small Business Advocate was to be no exception. So along cameJoseph V. Carcello to step up to bat at the hearing in opposition to HR 3784. By some measures his credentials were impressive, indeed with enough acronyms in the titles following his name to choke a horse (Ph.D., CPA, CGMA, CMA – well you get the picture). In Dr. Carcello’s words:

Well, as one who is a lawyer by training, there are at least three sides to be argued to every coin. The proposed SEC Office of Small Business Advocate was to be no exception. So along cameJoseph V. Carcello to step up to bat at the hearing in opposition to HR 3784. By some measures his credentials were impressive, indeed with enough acronyms in the titles following his name to choke a horse (Ph.D., CPA, CGMA, CMA – well you get the picture). In Dr. Carcello’s words:

“I have served as a professor at the University of Tennessee for over 20 years, where I teach accounting, auditing, and corporate governance. In addition to my teaching and research, my remarks are informed by my service on the Securities and Exchange Commission’s Investor Advisory Committee, an outside advisory group to the Commission which was statutorily created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the DoddFrank Act), and the PCAOB’s Investor Advisory Group, which is an outside advisory group to the PCAOB.”

Lacking from his resume, it seems, was any experience whatsoever outside of academia – outside, of course, the SEC’s Investor Advisory Committee and the PCAOB’s Investor Advisory Group. Perhaps it was this missing business experience which best explained the testimony he was about to present.

Lacking from his resume, it seems, was any experience whatsoever outside of academia – outside, of course, the SEC’s Investor Advisory Committee and the PCAOB’s Investor Advisory Group. Perhaps it was this missing business experience which best explained the testimony he was about to present.

Dr. Carcello had two noteworthy observations. First, he informed the Committee, a need for this new SEC office needs to first be documented:

“The Congressional record needs to clearly document the inability of small businesses to seek effective redress of problems through Congress and the SEC, and further indicate why the existing institutional mechanisms – the SEC’s Office of Small Business Policy, the SEC Government-Business Forum on Small Business Capital Formation, and the SEC’s Advisory Committee on Small and Emerging Companies — are not adequate to address any problems that might exist.”

Yet as an academic he himself had nothing to add to the Congressional record, good, bad or indifferent. OK, so far, no harm -no foul?

Dr. Carcello’s second noteworthy observation on the bill: it would create what he called a “quasi-lobbying” organization. In his words:

“Creating a quasi-lobbying group to seek a more favorable regulatory climate for small businesses may succeed in reducing the cost of regulation, but at the potential cost of greater information risk to investors – less transparent disclosures, a higher incidence of non-GAAP reporting as evidenced through restatements and, in the extreme, a higher incidence of financial fraud.”

Representative Carney very elegantly disposed of this witness, pointing out to Dr. Carcello that “pejorative” labels, as in his referring to an Office of Small Business Advocate as a “quasi-lobbying” organization, were counterproductive to formulating a bi-partisan (as in non-partisan) dialogue to formulate constructive solutions for what may ail our capital markets. There was no further testimony from that witness on the bill. By my estimation Dr. Carcello turned out to be the best witness in support of HR 3784.

The Small Business Capital Formation Enhancement Act

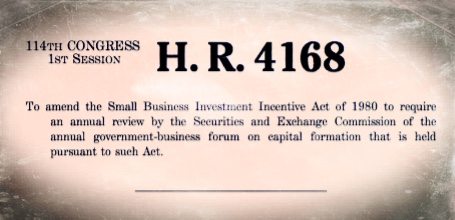

The other bill on the Hearing Agenda on December 2 which caught my eye was a bill introduced by Representative Poliquin (D-ME), in draft form. This draft bill encapsulated the simplest of requirements in the simplest of terms. Back in 1980 Congress passed a law requiring the SEC to hold an annual forum bringing together both government and small business constituents to discuss and propose initiatives to enhance capital formation for small businesses. However, as many, including myself have observed, the annual Forum has proven in large part to be a ritual devoid of meaning. History has shown that the recommendations of the Forum participants have been ignored by the Commission. The only saving grace of the Forum, it seems, has been that ultimately, years later some of these recommendations have been taken up by Congress in spite of the inaction of the SEC. The JOBS Act of 2012 is perhaps one of the best examples of the quality of some of the Forum recommendations that laid dormant with the Commission – only to be acted upon years later by Congress.

The other bill on the Hearing Agenda on December 2 which caught my eye was a bill introduced by Representative Poliquin (D-ME), in draft form. This draft bill encapsulated the simplest of requirements in the simplest of terms. Back in 1980 Congress passed a law requiring the SEC to hold an annual forum bringing together both government and small business constituents to discuss and propose initiatives to enhance capital formation for small businesses. However, as many, including myself have observed, the annual Forum has proven in large part to be a ritual devoid of meaning. History has shown that the recommendations of the Forum participants have been ignored by the Commission. The only saving grace of the Forum, it seems, has been that ultimately, years later some of these recommendations have been taken up by Congress in spite of the inaction of the SEC. The JOBS Act of 2012 is perhaps one of the best examples of the quality of some of the Forum recommendations that laid dormant with the Commission – only to be acted upon years later by Congress.

Hence, the proposed “Small Business Capital Formation Enhancement Act,” which would simply require the Commission, following the conclusion of each Annual Forum, to assess the findings and recommendations of the Forum and disclose the action, if any, the Commission intends to take with respect to such findings or recommendations.

Hence, the proposed “Small Business Capital Formation Enhancement Act,” which would simply require the Commission, following the conclusion of each Annual Forum, to assess the findings and recommendations of the Forum and disclose the action, if any, the Commission intends to take with respect to such findings or recommendations.

Once again, Dr. Carcello, the only hearing witness who was called to testify in opposition to this draft bill, instead seemed to make the case for the need for this proposed legislation. In Dr. Carcello’s view:

“. . . any individual participant at the Small Business Forum on Capital Investment [sic] can make a recommendation, resulting in the SEC receiving an excessive number of recommendations, some of which may be ill-formed and possibly not within the SEC’s purview. Requiring the SEC to respond to every recommendation is inefficient and a poor use of taxpayer resources, particularly given the chronic underfunding of the agency.”

For starters, it seems that Dr. Carcello didn’t even bother to read the bill he was testifying about. It requires the Commission to respond to findings and recommendations of the Forum – not to every Tom, Dick or Harry that attends the Forum and opens his or her mouth. And as to wasting taxpayer money, an annual gathering of hundreds of the best and the brightest at this Annual Forum, whose recommendations are ignored, is in and of itself a waste of taxpayer dollars – and much more.

For starters, it seems that Dr. Carcello didn’t even bother to read the bill he was testifying about. It requires the Commission to respond to findings and recommendations of the Forum – not to every Tom, Dick or Harry that attends the Forum and opens his or her mouth. And as to wasting taxpayer money, an annual gathering of hundreds of the best and the brightest at this Annual Forum, whose recommendations are ignored, is in and of itself a waste of taxpayer dollars – and much more.

To sum up some of the remarks at the Hearing by the bill’s Sponsor, Representative Poliquin, we assemble all of this talent to focus on how to better foster the growth of small business and our economy, so we ought to listen. After all, he pointed out, some of the recommendations have ultimately wound up as important, bi-partisan legislation, such as the JOBS Act. So it seemed to this Congressman that if a Forum proposal were to be rejected by the Commission, one ought to know why.

Sounded a lot like a letter I sent to the SEC on July 28, 2014, republished onCrowdfund Insider a few days later, stating in part:

“Given both the importance of capital formation for small business, the role of the SEC in facilitating capital formation, and the time, energy and resources expended by the Forum participants, perhaps it is time for the Commission to consider some element of “follow-up”, and accountability, by the Commission . . .”

A Bi-Partisan Holiday Gift for SME’s – Courtesy of Congress?

Well, I never did receive a response from the SEC to my July 28, 2014 letter. I expect Congressman Poliquin will have better luck, as will the sponsors of HR 3784, establishing an office of small business advocate at the SEC, judging by the progress of these bills. You see, according to the calendar of the Capital Markets Subcommittee, both of these bills have been scheduled for “markup” in this Committee on December 9, a fast pace for a bill by Capitol Hill standards. Moreover, the word on the street in DC is that these bills are quickly gathering broad bi-partisan support.

So write or call your Congressional representative, and tell them to please wish our small and emerging (and underrepresented) businesses a Happy and Prosperous 2016!

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also the President and Board Chair of the Crowdfunding Professional Association (CFPA). A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also the President and Board Chair of the Crowdfunding Professional Association (CFPA). A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation.

*************************

Editor’s Note – The following article appeared in Crowdfund Insider on December 8, 2015. On December 9, 2015, the House Financial Services Committee voted to approve the bill to establish an office of small business advocate at the SEC, HR 3784, by a vote of 56-0. The House Financial Services Committee also approved a bill to require the SEC to respond to recommendations made by the participants in the SEC’s Annual Government – Small Business Forum by a vote of 55-1. These two bills will now go to the full House of Representatives for a vote. Further details on these bills are available here.